Managing invoices manually can be a slow, error-prone, and frustrating process. Without a streamlined approval workflow, invoices often get stuck in review cycles, delaying payments and causing friction between departments. Businesses that rely on spreadsheets and emails for approvals risk financial mismanagement, compliance issues, and inefficiencies that hinder growth.

This is where invoice approval software comes in. By automating invoice approvals, organizations can eliminate bottlenecks, reduce processing time, and ensure compliance with company policies. A smart system seamlessly routes invoices to the right stakeholders, tracks approvals in real time, and integrates with accounting software for smooth financial operations.

In this article, we’ll explore the benefits of automating your approval workflow, how invoice approval software enhances processing, and what key features to look for when choosing the right solution for your business.

Why Automate Your Invoice Approval Workflow?

1. Faster Invoice Processing

Manual invoice approvals often involve multiple emails, spreadsheets, and back-and-forth communication. This slows down processing times and leads to delayed payments. Automating the approval workflow ensures that invoices move seamlessly through predefined approval chains, reducing turnaround time and improving vendor relationships.

2. Eliminate Errors and Fraud Risks

Human errors in invoice management, such as duplicate payments or missed approvals, can be costly. Automated invoice approval software provides built-in validation checks, duplicate detection, and fraud prevention mechanisms. This ensures that only verified invoices are processed and approved.

3. Increased Transparency and Compliance

A smart invoice approval system maintains a digital audit trail, ensuring that all approvals, rejections, and modifications are logged. This is crucial for compliance with financial regulations and internal audit requirements. Organizations can track who approved what, when, and why—eliminating ambiguity.

4. Seamless Integration with Accounting and ERP Systems

Leading invoice approval software integrates with accounting tools like QuickBooks, Xero, and ERP systems, ensuring that invoice data flows directly into financial records. This eliminates the need for manual data entry and reduces the risk of discrepancies between approved invoices and financial statements.

5. Cost Savings and Efficiency

Processing invoices manually is resource-intensive, requiring dedicated personnel for tracking and follow-ups. Automating the process cuts administrative costs, reduces paper usage, and optimizes staff productivity. Businesses can focus on strategic financial management rather than chasing approvals.

Key Features to Look for in Smart Invoice Approval Software

1. Customizable Approval Workflows

Your invoice approval process should align with company policies. Choose software that allows you to configure custom approval workflows based on invoice amounts, departments, and other parameters.

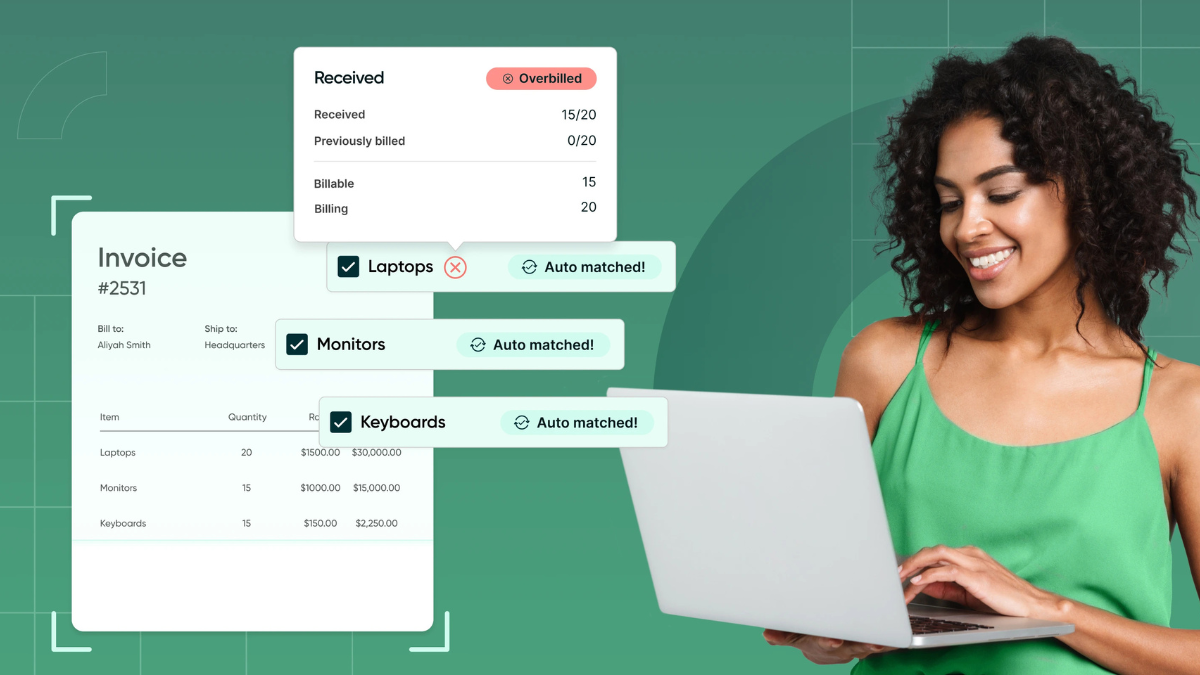

2. AI-Powered Invoice Matching

Advanced invoice approval tools leverage AI to match invoices with purchase orders and receipts. This prevents mismatches and ensures that only valid invoices are approved.

3. Real-Time Status Tracking

A centralized dashboard should provide real-time visibility into invoice approvals. Approvers should be able to view pending invoices, escalation points, and approval timelines.

4. Mobile Accessibility

With remote work becoming the norm, mobile-friendly approval software enables managers to review and approve invoices on the go, reducing bottlenecks.

5. Automated Notifications and Escalations

Timely reminders and automated escalation rules prevent invoices from getting stuck in approval loops. If an approver fails to act within a set timeframe, the system should escalate the invoice to the next authority.

6. Integration Capabilities

Ensure that the invoice approval software integrates with your existing tools—ERP, procurement systems, and accounting platforms—to create a seamless finance workflow.

How to Implement Automated Invoice Approvals in Your Business

Step 1: Identify Approval Bottlenecks

Analyze your current invoice approval process to pinpoint delays. Are invoices getting stuck due to slow approvals? Are there redundant steps that can be removed?

Step 2: Define Approval Rules and Hierarchies

Set up predefined rules for invoice approvals based on amount, vendor type, and urgency. Define approvers at each level and establish escalation protocols for delayed invoices.

Step 3: Choose the Right Invoice Approval Software

Evaluate software solutions based on your business needs. Look for features like AI-driven invoice matching, workflow automation, and seamless integration with your accounting systems.

Step 4: Train Your Team and Go Live

Once you implement the software, train finance teams and approvers on how to use it effectively. Monitor initial results, collect feedback, and fine-tune workflows for optimal performance.

Step 5: Continuously Optimize and Improve

Regularly assess system performance, approval turnaround times, and user adoption. Use analytics and reporting features to optimize your invoice approval process further.

Conclusion

Automating your approval workflow with smart invoice approval software eliminates inefficiencies, reduces errors, and accelerates financial operations. A well-designed system ensures timely approvals, strengthens compliance, and integrates seamlessly with your existing finance tools.

By adopting the right solution, businesses can streamline invoice processing, improve vendor relationships, and enhance financial transparency. If you’re still relying on manual approvals, now is the time to transition to a smarter, automated system.